Back at the Noosa library using their lightning fast internet. Not having a proper base is tedious sometimes.

While everyone on the media is spruiking the end of last week’s crisis crisis (hah!), Gail Tverberg has published a stupendous article on her blog titled Deflationary Collapse Ahead? Perhaps most of you have already read it, but I found it interesting that she’s getting more and more pessimistic with every post…..

My main take away from this article are:

-

The big thing that is happening is that the world financial system is likely to collapse. Back in 2008, the world financial system almost collapsed. This time, our chances of avoiding collapse are very slim.

-

Without the financial system, pretty much nothing else works: the oil extraction system, the electricity delivery system, the pension system, the ability of the stock market to hold its value. The change we are encountering is similar to losing the operating system on a computer, or unplugging a refrigerator from the wall.

-

We don’t know how fast things will unravel, but things are likely to be quite different in as short a time as a year. World financial leaders are likely to “pull out the stops,” trying to keep things together. A big part of our problem is too much debt. This is hard to fix, because reducing debt reduces demand and makes commodity prices fall further. With low prices, production of commodities is likely to fall. For example, food production using fossil fuel inputs is likely to greatly decline over time, as is oil, gas, and coal production.

-

The electricity system, as delivered by the grid, is likely to fail in approximately the same timeframe as our oil-based system. Nothing will fail overnight, but it seems highly unlikely that electricity will outlast oil by more than a year or two. All systems are dependent on the financial system. If the oil system cannot pay its workers and get replacement parts because of a collapse in the financial system, the same is likely to be true of the electrical grid system.

-

Our economy is a self-organized networked system that continuously dissipates energy, known in physics as a dissipative structure. Other examples of dissipative structures include all plants and animals (including humans) and hurricanes. All of these grow from small beginnings, gradually plateau in size, and eventually collapse and die. We know of a huge number of prior civilizations that have collapsed. This appears to have happened when the return on human labor has fallen too low. This is much like the after-tax wages of non-elite workers falling too low. Wages reflect not only the workers’ own energy (gained from eating food), but any supplemental energy used, such as from draft animals, wind-powered boats, or electricity. Falling median wages, especially of young people, are one of the indications that our economy is headed toward collapse, just like the other economies.

-

The reason that collapse happens quickly has to do with debt and derivatives. Our networked economy requires debt in order to extract fossil fuels from the ground and to create renewable energy sources, for several reasons: (a) Producers don’t have to save up as much money in advance, (b) Middle-men making products that use energy products (such cars and refrigerators) can “finance” their factories, so they don’t have to save up as much, (c) Consumers can afford to buy “big-ticket” items like homes and cars, with the use of plans that allow monthly payments, so they don’t have to save up as much, and (d) Most importantly, debt helps raise the price of commodities of all sorts (including oil and electricity), because it allows more customers to afford products that use them. The problem as the economy slows, and as we add more and more debt, is that eventually debt collapses. This happens because the economy fails to grow enough to allow the economy to generate sufficient goods and services to keep the system going–that is, pay adequate wages, even to non-elite workers; pay growing government and corporate overhead; and repay debt with interest, all at the same time.

We don’t know how fast things will unravel, but things are likely to be quite different in as short a time as a year…..

Needless to say, that one line blew me away. Even though I’m well aware of how badly things are going, I still scare myself silly reading this stuff.

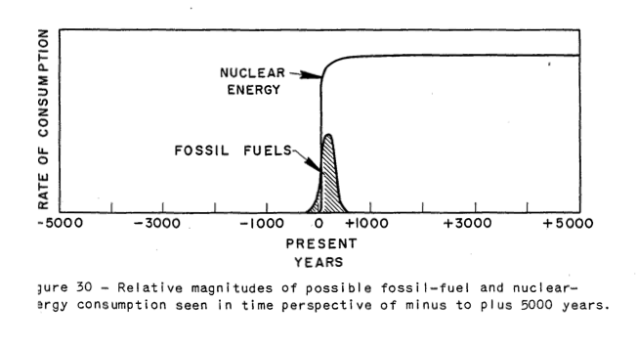

Then we have the above chart, which for me was the gotcha moment of my understanding of limits… that shaded area under the spike represents all the fossil energy ever used since the beginning of the industrial revolution to perhaps 20 or so years from now. The area of the rectangular block to the right of the spike is what idiots who believe in unending growth think will happen with ‘innovation and technology’. Possibly dozens of times the total amount of energy we extracted from coal, oil, and gas. The most stupendous energy sources we’ve ever had (and never will have again). Truly, fantasy land…

I have twelve months to get my act together at Mon Abri MkII, but literally no one I know believes a word of it or does anything about it. Some are even doing everything the wrong way and exposing themselves to losing everything….

Further reading that may interest you all too is Tom Murphy’s latest report on his EV experiment. Titled My Chicken of an EV, Tom clearly shows why he believes batteries will disappoint….

From the data, I see that the battery capacity is at about 85% of its original condition. While extrapolation is highly risky, it would seem that I can expect zero capacity on the scale of six years, based on its accelerating decline. At this point, we have put about 500 full-cycle-equivalent charges on the battery in about 700 charge events (just shy of one per day, typically about 70% depth). So perhaps it’s not surprising: few batteries can withstand more than 1–2000 charge cycles before giving out. – See more at:http://physics.ucsd.edu/do-the-math/2015/08/my-chicken-of-an-ev/#more-1535

Take Away

While obligated to point out the financials, I am the last to feel enslaved by a strict dollars-and-cents analysis. There are other reasons to go for an EV: reduced reliance on petroleum, solar charge capability, quiet, efficient, support of a nascent technology, etc. For me, energy is a hobby. I buy an expensive car and expensive solar batteries because I want to learn more about their pros and cons. In part, I am glad that I can export what I learn to the people. Most folks do not have the financial or technical capabilities to look into possibly-hyped technologies and report, free of financial agenda.

I am not yet personally convinced that we will see an EV revolution. Gasoline price fluctuations are a short-term killer of long-term planning. Batteries still do, and likely always will, disappoint. I am learning similar lessons on the nickel-iron battery front. We may have to face the fact that gasoline has been the ultimate transportation fuel, and the economists’ picture of universal substitutability may not apply. If EVs can never really outperform gasoline in cost, ease/simplicity, convenience, and robustness—and if they remain expensive to own and maintain, from where will the prosperity derive for us to all have such marvelous toys?

Meanwhile, I will continue to enjoy my EV and my chickens while they last, as a lifestyle choice. The cost per egg or cost per mile certainly do not justify them. So we need to be satisfied by other reasons.

Tom is apparently working on another report on the NiFe batteries I’m hoping to install in Geeveston, and he has prepared all his readers for some more disappointment. Hopefully, he hasn’t understood exactly how they are meant to be used, so watch this space.

John Doyle, if you read this, how do I get in touch with you?

Eight more sleeps, and I’m off into the Tasmanian sunset.

It seems everyone is looking to China, but the world’s 7th biggest economy, Brazil, is on the ropes, having officially gone into recession in the last quarter.

http://www.bbc.com/news/business-34088144

Only part of Brazil’s woes are being attributed to China’s slow down. This global meltdown seems to be more than one of those blips – those Wall St number crunchers are looking decidedly pale and are using a lot of grim superlatives in their language, even as they talk up a recovery.

The falling wages of young people, all by itself, is capable of crashing our civilization. The 1% want it all , they will get it, but it will be all of nothing. People with no access to money do not spend money. Poor people spend their money quickly, the super rich spend a tiny fraction. As all the money flows up the financial pyramid it slows down, when the 1% have it all the flow stops. No flow, no economy and everything stops. Game over.

Our economic social system is designed to grow and grow. It cannot do no or slow growth. Grow or crash are the only options and more growth is impossible, the illusion of growth is becoming impossible. When we cannot see growth, crash happens.

Our systems are highly interrelated, stressed and very complex, far more than any previous civilization. Catastrophic, cascading failure is not only probable it is inevitable. Our ability to go it alone is pretty much non existent. Our supply chains have little storage and will start to run down within days.

In a few years, Need a screw to fix something, tough they are not made in Australia.